SPECIALTY CLAIMS AVOIDANCE

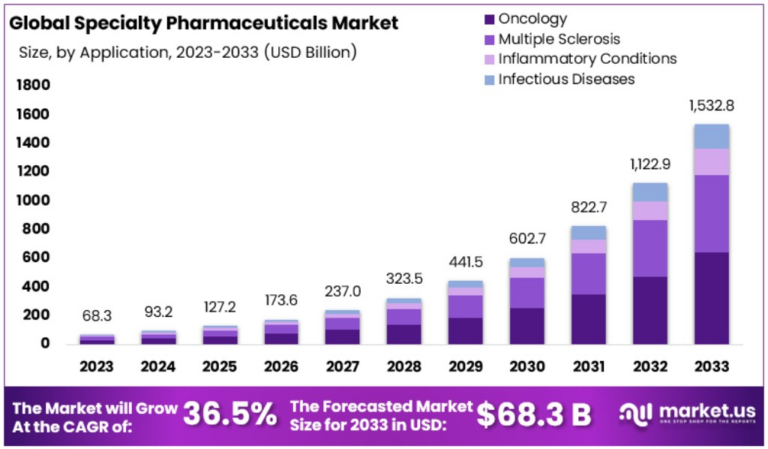

Specialty treatments continue to be the fastest growing area of pharmacy spend, with utilization as the main driver

As renewals approach, are you prepared with a Specialty Drug solution for your clients?

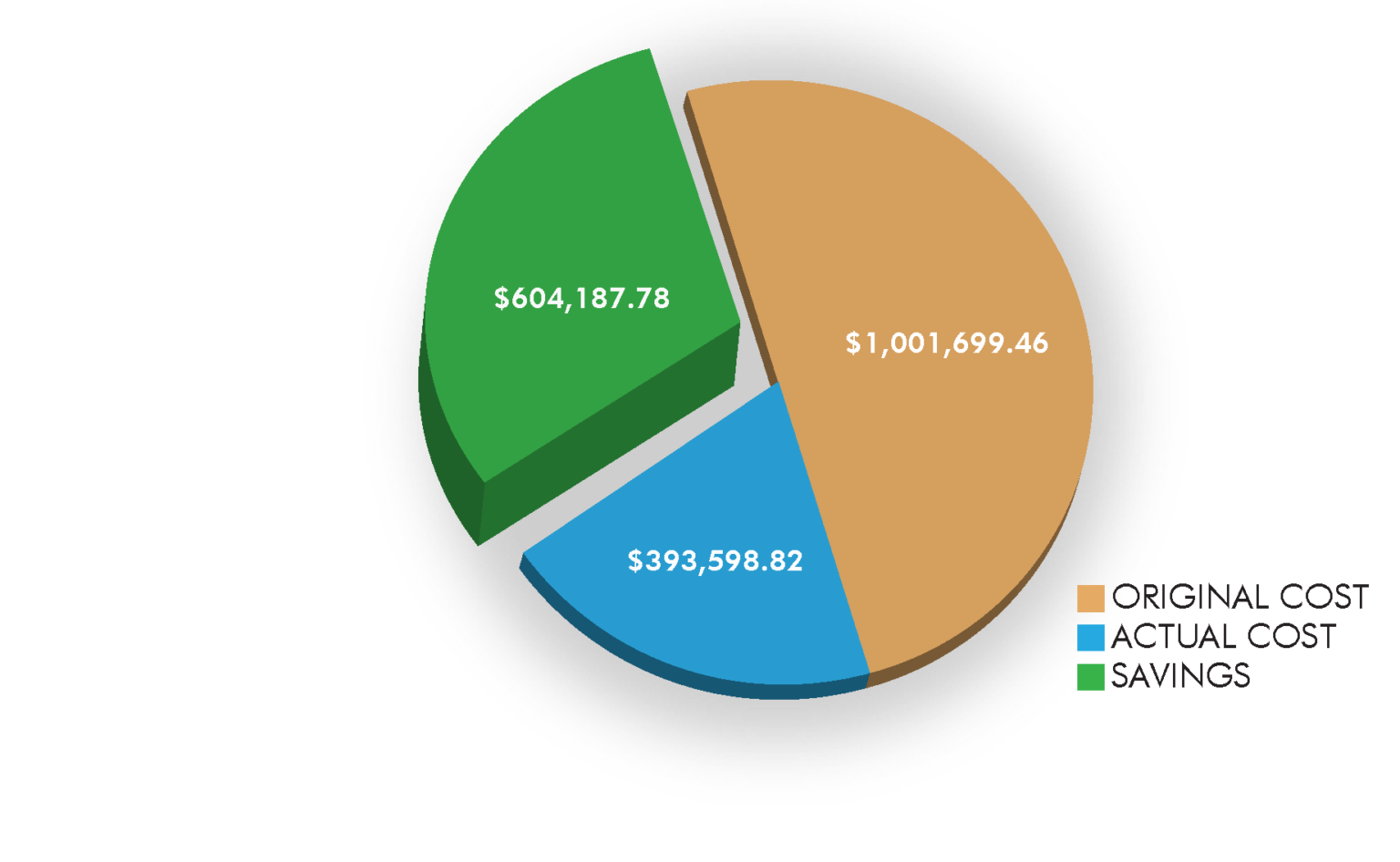

Here is a 2023 case study from one of our brokers:

- 1 Broker

- 12 Self-Funded groups (3000 lives)

- 37 Patients

- 103 Specialty Scripts Dispensed

- 6 Month Savings: $604,187.78

- Commissionable and Passive

Here is what the industry is saying about Specialty Medications and its costs:

WHAT'S THE SOLUTION?

Some PBMs recommend Copay Optimization, Embedded Disease Management and Medical Specialty Management. Other consultants suggest a similar approach to controlling specialty costs.

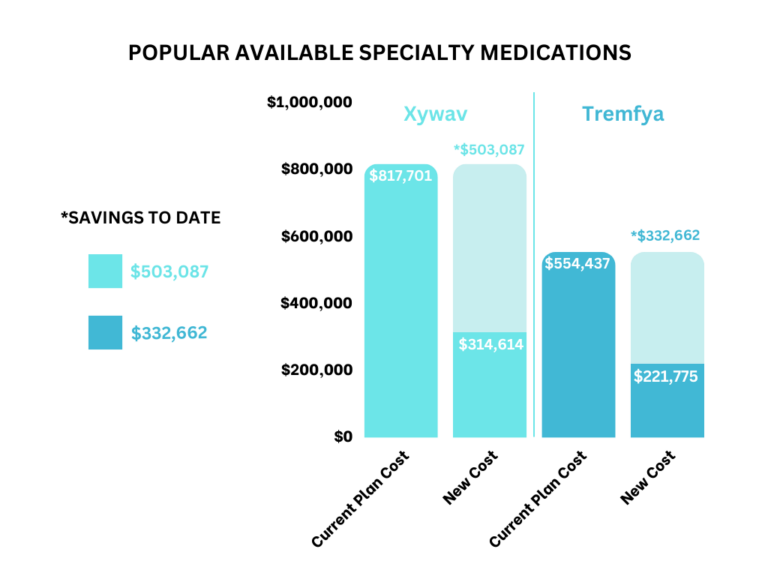

The important thing to note is that this cost is being generated by less than 3% of the covered population. We offer a fairly simple solution. It works with these small number of patients, which means no disruption for 97% of your population. These programs can be implemented off-renewal cycle and produce almost immediate savings. Eligible patients pay no deductible or copay and the plan saves 40-60% off the retail cost.

PRICE INFLATION

Specialty drugs are not only commanding the pharmaceutical market, they are replacing lower-cost therapies. According to a Segal Report, 40% of new products recently launched by drug manufacturers were specialty medications. These drugs are now being pushed at a higher rate than non-specialty drugs, contributing to price inflation.

Specialty drug utilization increased nearly 6% in 2020, whereas non-specialty drug usage remained relatively the same. And there is little recourse for anyone seeking a cheaper alternative to these specialty pharmaceuticals.

There are currently few biosimilar drugs(similar to the name brand drug’s composition, but not identical) that can be used in place of specialty medications-the FDA only approved two in the first half of 2020 and 10 in all of 2019. However, as more biosimilar drugs are approved, drug manufacturers are expected to introduce other countermeasures to maintain their marker share and profits (Griffin, 2021)

INFLUX OF SPECIALTY DRUGS

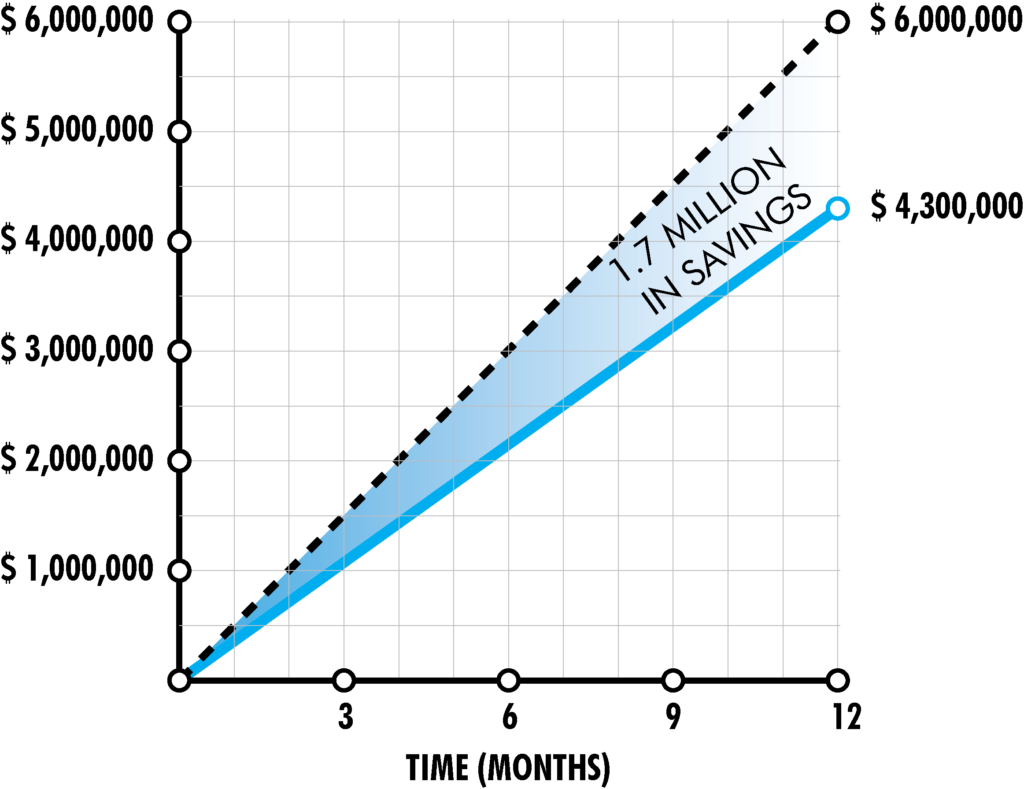

Here is a savings example from 3500 life Medical Group

- Effective 5-1-21

- 24 current patients (>1% of the group)

- $6 million in total annual drug spend

- $1.7 million in annual Specialty Savings

- Reducing the total drug spend by 28% in 1 year

The Pharmacy Exchange provides PROVEN and EFFICIENT ways to reduce specialty spend. In most cases a savings of 60% off each program is available for specialty medicine. To submit a de-identified quote, click on the link below. It does not cost you anything to obtain a quote, If you provide just a few de-identified fields from you or your client’s monthly drug claim file.

Please contact us at info@pharmaex.org for more information

References:

Brown, Raymond. “Managing Specialty Pharmacy Costs: What To Look For In The Data.” Managing Specialty Pharmacy Costs: What to Look for in the D, 2021, www.mmc.com/insights/publications/2021/may/managing-specialty-pharmacy-costs.html.

Griffin, Jeff. “Prescription Drug Pricing Trends.” JP Griffin Group | Employee Benefits Broker, 20 Jan. 2021, www.griffinbenefits.com/blog/prescription-drug-pricing-trends-2021.

Steiber, Dan. “Editor’s Note: Top Trends for 2020 in Specialty Pharmacy.” Pharmacy Times, 15 Feb. 2020, www.pharmacytimes.com/view/editors-note-top-trends-for-2020-in-specialty-pharmacy.